Broad Market vs. Sector ETFs: Risk & Return Revisited (2007–2024)

What 18 years of data reveal about returns, risk, and the importance of checking AI‑assisted work

Abstract:

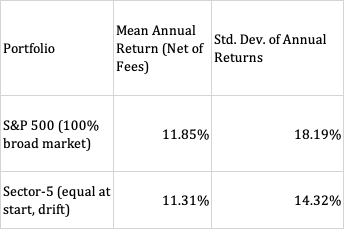

We compare two low‑cost U.S. equity strategies over 2007–2024: a 100% allocation to the S&P 500, and an equally funded five‑ETF sector sleeve (Technology, Energy, Utilities, Consumer Staples, Health Care) set once in 2007 and left to drift. Using annual total returns, we find similar average returns but meaningfully lower volatility for the five‑ETF mix.

The results presented here consist exclusively of results that CHAT GPT could generate with available data. We close with a brief discussion of how AI tools could enable larger advances in finance if connected directly to monthly/weekly/daily market databases.

Introduction

Two representative investors are compared from 2007 through 2024: (1) a Broad‑Market investor holding 100% tracking the S&P 500; and (2) a Sector investor holding five Select Sector ETFs, funded equally (20% each) at the start of 2007 and then allowed to drift without rebalancing. The goal is to understand how these choices affect return and volatility in practice.

The project also documents how the author and ChatGPT collaborate.

Methods

We transcribed annual nominal total returns (dividends reinvested) for S&P 500, XLK, XLE, XLU, XLP, and XLV for 2007–2024 from a public source. For the S&P 500, we computed the arithmetic mean and standard deviation of the annual return series. For the sector sleeve, we initialized weights at 20% each in 2007, computed each year’s portfolio return as the beginning‑of‑year weighted average of ETF returns, and let weights drift with performance. We repeated the same mean and standard‑deviation calculations on the resulting sector‑portfolio return series. Low fees were modeled as small annual drags (S&P 500 0.09%; sectors 0.08%), which do not change volatility but reduce mean.

CHAT GPT initially provided results based on monthly data but a review by the author found the results were not based on real data, were simulated. Soon the author will upload data to provide more complete results.

Also, hopefully soon CHAT GPT will be connect to databases which would facilitate quick creation of more complete studies.

Results: Annual Data (Confirmed)

The annual calculations above are fully computed from the transcribed total‑return series with fees applied as annual drags.

A request was made to CHAT GPT to calculate mean and standard deviation of returns based on monthly data. CHAT GPT provided a table, but a discussion with CHAT GPT revealed that this table was a mock up, not based on real data. I would be more confident in these results if CHAT GPT had immediate access to monthly data.

Discussion / Analysis

The confirmed annual results show that the sector sleeve delivered a similar average return to S&P 500 but with materially lower volatility (≈14% vs. 18%).

Some observations and comments:

· Sector diversification distributes risk across distinct economic exposures,

· Drift without rebalancing still tempers single‑sector shocks while allowing relative winners to compound,

· Both approaches are low‑fee,

· Diversified sleeves can offer a smoother ride without sacrificing mean return in this sample.

Next Steps:

A natural next advance is to embed AI into a database with extensive stock price and financial information all available to the public for a nominal fee.

With such connections, ChatGPT could automatically: (1) pull and clean data; (2) run monthly/weekly return analyses alongside annual; (3) generate audit trails (code + versioned data snapshots); and (4) update tables and charts as new data arrive.

This innovation would lead to a huge increase in high quality verifiable financial research.

Discussion of previous literature:

We did not locate a peer‑reviewed paper that tests a static five‑ETF (Tech, Energy, Utilities, Staples, Health Care) portfolio directly against a single S&P 500 core over U.S. data.

The closest work is indirect, focusing on equal‑weight indices, industry/sector momentum, and sector‑rotation efficacy.

Evidence consistent with our findings includes papers on

(i) the robustness of naive equal‑weight (1/N) allocation out‑of‑sample,

(ii) periods in which equal‑weighting and reduced concentration compare favorably with cap‑weighting;

(iii) risk‑reduction from sectoral diversification.

See appendix for relevant citations.

Conclusion

Over 2007–2024, the five‑ETF sector sleeve matched S&P 500’s average annual return while delivering substantially lower volatility in the confirmed annual analysis. For investors, the trade‑off is clear. The strategy of a single core fund is simpler, but a mix of sector funds can potentially match the core fund in total return while minimizing risk.

A fuller analysis is needed. This research and other financial research would go much more smoothly if AI was linked to clean financial data.

Appendix: Methods, Replicability & Research Agenda

• Initial method: We used annual total returns to compute mean and standard deviation for S&P 500 and for a five‑sector sleeve initialized equally in 2007 and allowed to drift. These results are fully computed and confirmed.

• Requested revision: The author asked for results based on the entire time series of monthly returns (a stronger basis for volatility estimation). We outlined the method (monthly adjusted closes → monthly returns → annualization) and intended to produce a downloadable workbook, once data becomes available.

Light Research Agenda

1. Extend analysis to all 11 GICS sectors equally weighted.

2. Test rebalancing frequency (annual vs quarterly vs no rebalance) for volatility and return trade‑offs.

3. Compare drawdown patterns (e.g., Global Financial Crisis, COVID‑19 shock) across S&P 500 and sector sleeves.

4. Assess role of factor exposures (value, momentum, quality) across the two strategies.

5. Explore whether combining a broad core ETF with a sector sleeve can replicate active management outcomes at lower cost.

Replicability Box

Readers can replicate the analysis with Python using free libraries. Example code:

import yfinance as yf, pandas as pd

tickers = ['S&P 500','XLK','XLE','XLU','XLP','XLV']

data = yf.download(tickers, start='2007-01-01', end='2024-12-31')['Adj Close']

monthly = data.resample('M').last().pct_change().dropna()

# Compute returns, portfolios, stats as shown in the Methods section.

Essential Reading

DeMiguel, Garlappi & Uppal (2009). Optimal versus Naive Diversification: How Inefficient is the 1/N Portfolio Strategy? Review of Financial Studies. https://academic.oup.com/rfs/article-abstract/22/5/1915/1592901

S&P Dow Jones Indices (2023). More Equal than Others: 20 Years of the S&P 500 Equal Weight Index. https://www.spglobal.com/spdji/en/documents/research/research-more-equal-than-others-20-years-of-the-sp-500-equal-weight-index.pdf

Vanguard (2025). What to consider when choosing between index‑weighting approaches. https://www.vanguard.co.uk/professional/insights-education/insights/what-to-consider-when-choosing-between-index-weighting-approaches

Moskowitz & Grinblatt (1999). Do Industries Explain Momentum? Journal of Finance. https://www.jstor.org/stable/798005

Molchanov et al. (2024). The myth of business‑cycle sector rotation. International Journal of Finance & Economics. https://onlinelibrary.wiley.com/doi/full/10.1002/ijfe.2882

Luft & Schiller (2017). Exchange‑Traded Funds: Sector Performance and Characteristics. The Journal of Index Investing. https://www.pm-research.com/content/iijindinv/7/4/51

S&P DJI (2025). U.S. Equal Weight Sector Dashboard. https://www.spglobal.com/spdji/en/documents/performance-reports/dashboard-us-equal-weight-sector.pdf

Yaman (2025). The benefits of sectoral diversification for investors with different risk perceptions. Finance Research Letters. https://www.sciencedirect.com/science/article/pii/S2214845025000444