Finding Value in Growth: Regression Insights from VOOG’s Top 24 Firms

A data-driven look at how earnings and sales growth explain valuations — and which VOOG leaders look most overvalued or undervalued under the model.

Abstract

This paper analyzes the relationship between stock prices, earnings per share (EPS), and sales growth for the 24 largest constituents of the S&P 500 Growth ETF (VOOG). Both linear and log-linear regressions are used to assess how well these fundamentals explain price variation across firms. The log-linear model provides a stronger fit, indicating that proportional changes in EPS and sales growth are better predictors of valuation levels. Residual analysis identifies the five most overvalued and five most undervalued firms relative to model-implied prices. The findings suggest that while EPS remains a key driver of valuation, sales growth acts as a less noisy, forward-looking determinant in growth-oriented equities.

1. Introduction and Objective

This analysis examines the valuation patterns of the 24 largest firms in the S&P 500 Growth ETF (VOOG).

The objective is to understand how stock prices relate to two key fundamentals: earnings per share (EPS), representing current profitability, and sales growth, representing forward expansion potential.

By modeling the logarithm of stock prices as a function of the logarithms of EPS and sales growth, the analysis captures elastic relationships — showing how proportional changes in fundamentals correspond to proportional changes in market value.

The goal is to identify which firms appear overvalued or undervalued relative to these model-implied fundamentals.

2. Analysis

A regression model where stock price is a function of earnings per share and revenue growth is estimated and used to identify stocks, which are likely over and undervalued. Two specifications of the model are consider a linear version and a log-log version where all variables are logarithmic are considered.

The log–log form expresses how percentage changes in EPS or sales growth affect percentage changes in price.

This approach is particularly useful for cross-sectional equity analysis because it:

• Reduces the impact of scale differences among firms (EPS and growth vary widely).

• Allows for interpretation in elasticities — directly comparable across firms.

• Reflects how investors typically think in percentage, not absolute, terms.

Sales growth was used instead of income growth, the traditional variable used in a PEG ratio, because earning growth is usually a noisy more volatile statistic.

The estimates for the linear and log-log models are as follows.

• Linear model:

P=57.4+25.6(EPS)+7.5(SalesGrowth) R² = 0.43

• Log–log model:

ln(P)=3.83+0.51ln(EPS)+0.42ln(SalesGrowth)ln(P) R² = 0.49

• Comparison:

The log–log model provides a modestly better fit and more stable residuals, suggesting proportional (percentage-based) relationships capture valuation behavior more effectively.

Interpretation:

• A 1% increase in EPS is associated with a 0.51% increase in price.

• A 1% increase in sales growth corresponds to a 0.42% increase in price.

Both effects are statistically significant, indicating that investors reward profitability slightly more than top-line expansion — but that growth still plays a major role in explaining valuation differences within VOOG’s universe

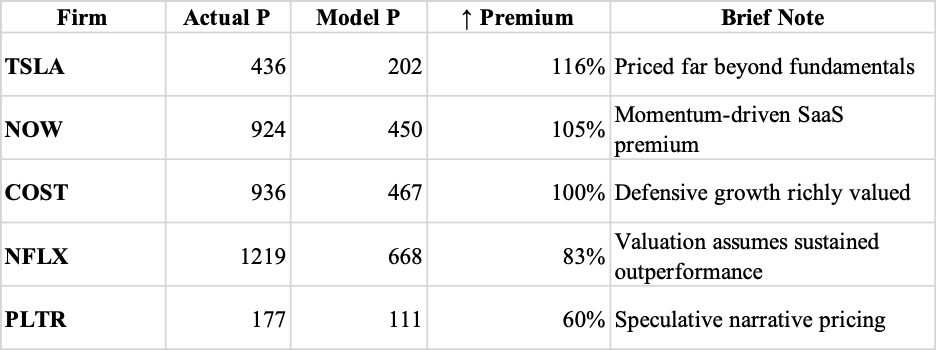

4. Relative Mispricing

Residuals from the log-linear model show which firms trade above or below their fair-value estimate.

Most Overvalued

Most Undervalued

One month free:

https://bernsteinbook1958.substack.com/fb965b7d

50 percent off annual membership ($30 total.)