How Roth Allocations Quietly Extend Retirement Life

A Comparison of Traditional and Roth Mixes in Tax Efficiency and Portfolio Longevity

This analysis compares three retirement income mixes—100% Traditional, 75/25, and 50/50 Traditional/Roth—under identical inflation and tax conditions. Because Roth withdrawals aren’t counted toward taxable income or Social Security benefit thresholds, they reduce both direct and indirect taxes over time. The result Roths allow for reduced gross withdrawals leading to longer portfolio life without cutting spending.

Key Findings

Compares three retirement income mixes: 100% Traditional, 75/25, and 50/50 Traditional/Roth, under identical inflation and tax assumptions.

Holds after-tax consumption constant, showing that Roth allocations improve tax efficiency rather than lifestyle.

Retirees with Roth assets can meet the same spending goal with 5–10 percent smaller withdrawals, extending portfolio life by roughly 1 to 1.5 years.

Fixed Social Security tax thresholds cause rising taxable benefits over time; Roth income slows this inflation-driven “tax creep.”

Extends prior work on Roths as an inflation hedge, demonstrating their added value as a long-term sustainability tool for retirement planning.

Introduction

This analysis compares three retirement income strategies under identical economic and tax assumptions:

100% Traditional IRA/401(k) assets,

75/25 Traditional/Roth mix, and

50/50 Traditional/Roth mix.

Each retiree begins with $1,000,000 and receives $25,000 in annual Social Security benefits. Withdrawals begin at 4% of initial assets ($40,000) in year one, and both withdrawals and Social Security grow with inflation at 5% per year for 40 years. The federal tax system and standard deduction are indexed to inflation, but the income thresholds for taxation of Social Security benefits remain fixed.

Results show that introducing Roth assets reduces the portion of Social Security subject to taxation and lowers total federal income tax. This allows a retiree to achieve the same after-tax lifestyle with smaller gross withdrawals each year, extending portfolio longevity.

Relation to Previous Research

This paper extends the framework introduced in Roth IRAs as an Inflation Hedge in a World of Frozen Social Security Tax Thresholds

(https://bernsteinbook1958.substack.com/p/roth-iras-as-an-inflation-hedge-in).

That earlier study examined single and married retirees with modest Roth allocations (around 10%) and demonstrated that even small Roth balances reduce both direct taxes on withdrawals and indirect taxes on Social Security benefits as inflation gradually exposes more benefits to taxation.

The present analysis builds on that foundation by testing larger Roth allocations (25% and 50%) across a 40-year horizon, explicitly modeling annual distribution rates and portfolio longevity. The results confirm and extend the earlier conclusion: Roth diversification acts as both an inflation hedge and a long-term sustainability tool for retirement income planning.

Assumptions and Methodology

Initial Portfolio: $1,000,000 per retiree.

Withdrawal Rate: 4% of initial balance in year 1 ($40,000).

Inflation: 5% annually; all withdrawals, tax brackets, and deductions rise with inflation.

Social Security: $25,000 initial benefit, also indexed to inflation.

Taxation of SS: Follows current-law thresholds ($25,000 / $34,000 for single filer), which are not inflation-indexed.

Return Assumption: 0% real; portfolios grow only with inflation indexing of withdrawals.

Tax Schedule: 2025 federal brackets indexed annually; standard deduction indexed.

For each scenario, the model computes:

Annual taxable portion of Social Security,

Federal tax due,

After-tax resources for consumption,

Required pre-tax withdrawals to maintain a consistent after-tax standard of living, and

Portfolio depletion year given those withdrawals.

The simulator computed annual distribution rates for each portfolio mix such that all investors enjoyed the same after-tax resources in each year, with the spending target defined by the all-Traditional plan’s after-tax income path.

Results Overview

After-Tax Consumption (Set Equal by Construction)

Each retiree is modeled to have identical after-tax resources available for consumption in every year. To achieve that equality, retirees with Roth assets withdraw smaller gross amounts, since Roth income lowers total taxes.

· • 100% Traditional: Year 1 after-tax consumption $59,800 (baseline).

• 75/25 Mix: Withdraws about 5% less each year to maintain the same after-tax consumption.

• 50/50 Mix: Withdraws about 10% less each year to maintain the same after-tax consumption.

Because after-tax resources are held constant by design, the differences among scenarios appear in withdrawal rates, tax paid, and portfolio longevity—not in spending levels. Roth income thus improves tax efficiency rather than raising total consumption.

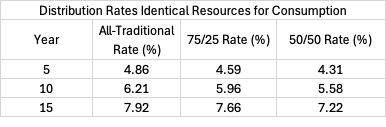

Distribution Rates

When retirees are constrained to live on the same after-tax amount as the all-Traditional case, those with Roth assets can withdraw smaller percentages of their portfolios each year:

All-Traditional: Average distribution rate ≈ 6.2% of portfolio over 40 years.

75/25 Mix: ≈ 5.9%.

50/50 Mix: ≈ 5.6%.

Average distribution rate” refers to the mean of annual withdrawals divided by remaining balances, which naturally rises over time as portfolios decline.

The gap widens slowly with time, reflecting compounding tax drag for the Traditional retiree.

Authors Note: Final results behind paywall. If you’d like to support this work — and receive premium posts, working drafts, and early access to new analyses — I’m offering two introductory options:

· 🎓 Six months free for new paid subscribers

· 💡 50% off an annual membership (only $30 total)

Paid subscribers receive a steady stream of research-driven writing on personal finance, health insurance, retirement strategy, and the stock market. Your support makes it possible to continue and expand this kind of work.