Inflation and the RAP Trap: How Rising Prices Undermine Loan Affordability

How inflation erodes the promise of Trump’s new Repayment Assistance Plan for affordable loan repayment.

Introduction

The purpose of income-driven repayment (IDR) is to make education loans affordable relative to a borrower’s ability to pay. By tying payments to income, IDR plans aim to avoid repayment burdens that crowd out essential living costs.

However, the Repayment Assistance Plan (RAP) introduced in the 2025 Tax Bill departs from prior IDR designs. It applies tiered percentages to all adjusted gross income (AGI) without an inflation-adjusted income shield and requires 30 years of qualifying payments for forgiveness. This design can become distorted by inflation over time.

If repayment obligations rise faster than the borrower’s real purchasing power—simply because nominal income crosses higher brackets—the intended protection of IDR is undermined. This paper illustrates the issue by comparing RAP to conventional fixed-term loans and to the SAVE plan’s inflation-resistant disposable-income formula.

Comparisons and Results

We analyze a typical new undergraduate borrower:

• Loan balance: $35,000

• Starting AGI: $62,000

• Interest rate: 6.5% fixed

• Household: single borrower, no dependents

We compare:

RAP: tiered AGI-based payments, no income shield

Conventional fixed-term loans: 10-year and 20-year standard amortization

We model a 2.5% annual inflation rate over 10 years, scaling both loan balance and starting AGI proportionally.

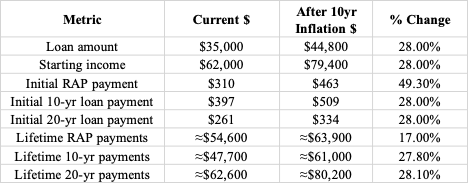

Key Results

Note: Lifetime RAP payments rise more slowly than the initial monthly payment because higher RAP payments shorten repayment time—from about 176 months (14.7 years) in the baseline to about 138 months (11.5 years) after 10 years of inflation.

Analysis

Inflation Distorts RAP’s Affordability

The purpose of IDR is to adjust repayment to a borrower’s real capacity to pay. Under RAP, however, inflation alone pushes borrowers into higher payment tiers, increasing monthly payments by about 49% versus about 28% for conventional loans in our scenario.

This “bracket creep” occurs even though the borrower’s real standard of living has not improved—only the nominal wage increased. The consequence is that RAP diverts a growing share of income to loan repayment, defeating the core affordability purpose of IDR.

Baseline Affordability Already Weaker than 20-Year Loan

Even at the start of repayment, RAP’s $310 monthly payment is higher than the $261 required for a conventional 20-year loan. The RAP provisions for potentially lower payments and debt relief do not tremendously assist the typical undergraduate borrower.

While RAP provides forgiveness after 30 years, this benefit is too distant to offset higher near-term burdens, especially for borrowers with moderate incomes.

RAP’s higher initial payment shortens payoff time, leading to lower interest costs and thus lower lifetime payments than the 20-year loan in both scenarios. However, the rising monthly burden makes RAP less affordable month to month, particularly during early career years when liquidity matters most.

SAVE and similar IDR plans base payments on disposable income above a fixed real threshold (for example, a poverty-line multiple). As both income and threshold rise with inflation, the real repayment burden remains stable—there is no bracket creep. Such plans maintain their original affordability goal regardless of the inflation rate.

Conclusions

RAP’s design exposes borrowers to inflation-driven increases in payment obligations, undermining the very reason IDR plans exist—to align repayment with a borrower’s real capacity to pay. Initial affordability for SAVE and other IDR programs, which were based on a disposable income concept and did not include multiple payment brackets, was not distorted by inflation. Policymakers should consider indexing RAP’s brackets to inflation or reinstating a real-income-based shield to ensure that the program meets its stated objective: making loan repayment affordable, not increasingly burdensome, in an inflationary environment.

Authors Note: The paid version of this blog has substantial advice for investors, including these articles

Four quality stocks in the valley: When to step in?

Series I bonds vs. Bond Funds: 27 years of Head-Head Results

There are two coupons for potential paid subscribers

Annual membership for paid subscriber 50 percent off $30.

https://bernsteinbook1958.substack.com/4d9daaf9

One month free link to Economic and Policy Insights