Preliminary Results: The Retirement Date Lottery: Why 2000 and 2007 Retirees Lived Different Financial Realities

How sequence-of-returns risk can make or break retirement security — even under the same withdrawal rule.

Abstract:

What if two retirees followed the exact same withdrawal strategy, invested in the same portfolio, and started with the same nest egg — but one retired in 2000 and the other in 2007? By 2025, their outcomes are worlds apart. This post shows how the timing of retirement interacts with market downturns, reshaping financial security in ways that averages can’t capture.

Introduction

A central question in retirement planning is whether assets will sustain a retiree for decades. While much attention is paid to long-term averages — “the market returns 8% per year” — reality is not so smooth. The actual path of returns, especially in the first years of retirement, often matters more than the averages. This is known as sequence-of-returns risk: the danger that poor returns early in retirement permanently deplete wealth, even if markets recover later.

This memo highlights the dramatic impact of retirement start date by comparing two cohorts: one retiring in January 2000, just before the dot-com crash, and another in January 2007, just before the global financial crisis.

Both start with the same assets, withdraw using the same 4% rule, and invest in either a 100% stock portfolio (SPY) or a balanced 60/40 fund (FBALX). The results show that retirement security can hinge on the simple accident of when retirement begins.

Methodology

Initial balance: $1,000,000.

Withdrawal rule: 4% of initial balance ($40,000 annually), adjusted for CPI each March.

Frequency: Withdrawals taken monthly (annual ÷ 12).

Portfolios:

SPY: S&P 500 ETF (100% equities).

FBALX: Fidelity Balanced Fund (~60% stocks / 40% bonds).

Cohorts:

Retiree beginning January 1, 2000.

Retiree beginning January 1, 2007.

Results

Key Findings

Sequence-of-returns risk dominates retirement outcomes.

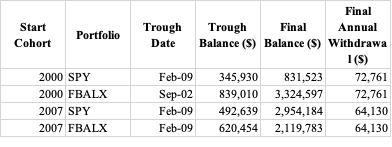

The 2000 SPY retiree faced two severe downturns at the very start: the dot-com collapse (2000–2002) and the global financial crisis (2007–2009). Ongoing withdrawals during those downturns locked in losses, leaving the retiree with only ~$832k by 2025 — despite strong later market returns.

Impact of retirement date (2000 vs 2007).

The 2007 SPY retiree avoided the dot-com bust, entering retirement just before the GFC. While balances plunged in 2008–09, the subsequent bull market drove the portfolio to nearly $3.0M by 2025.

Two retirees, following identical rules and portfolios, ended with a 3.5x difference in wealth simply because of start date.

Diversification cushions early losses.

FBALX mitigated drawdowns in both cohorts. For the 2000 retiree, FBALX preserved enough capital to finish with $3.3M, vastly outperforming SPY’s $832k.

For 2007 retirees, FBALX provided a smoother ride, though its final balance lagged SPY due to bonds’ lower long-run returns.

Inflation steadily raises withdrawals.

By 2025, annual withdrawals grew to ~$73k for the 2000 retiree and ~$64k for the 2007 retiree. Larger withdrawals magnified the stress of early downturns.

Conclusion

Retirement security depends not only on average market returns and chosen portfolio but also on when retirement begins.

FBALX outperformed SPY for the person retiring in 2000.

SPY outperformed FBALX for the person retiring in 2007.

A retiree starting in 2000 with SPY saw wealth eroded by two crashes.

Retirement planning when people are entirely dependent on assets in a 401(k) plan is difficult and the outcomes described here would have been much worse in the financial environment that existed in the 1970s and 1980s.