Sales Growth Differences Across Growth, Value, and Overlap Stocks in VOOG and VOOV Holdings

Where do stocks in both value and growth ETFs belong?

Before you model style drift, you need to know whether the “overlap” names in VOOG and VOOV actually behave like growth or like value. This is the first statistical pass: we compare expected sales growth across growth-only, value-only, and overlap stocks to see where the overlap cohort actually belongs. If you care about how real fundamentals line up with ETF labels — this is the ground truth you need before building anything on top of it.

MEMORANDUM

Subject: Statistical comparison of growth, value, and overlapping stocks using normalized sales growth

Date: (Date)

Overview

This memorandum evaluates differences in expected sales growth across three equity cohorts derived from the top holdings of two style-defined Vanguard ETFs. The growth cohort was taken from the top 25 constituents of VOOG (Vanguard S&P 500 Growth ETF), and the value cohort from the top 25 constituents of VOOV (Vanguard S&P 500 Value ETF). Five securities — MSFT, AAPL, AMZN, JPM, and BRK.B — appeared in both ETFs. Those were assigned to a separate “both” category, while the remaining securities were retained in mutually exclusive growth-only or value-only groups.

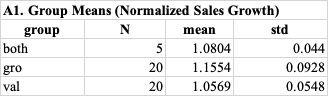

For each security, expected next-year sales growth was collected from the Revenue Estimate section of the Yahoo Finance “Analysis” tab, using the “Next Year” column of the Sales Growth (year/est) row. To express this expected growth on a proportional scale, the percentages were normalized by dividing the sales growth percentage by 100 to make it a ratio and adding 1.0

For example, a 14% expected growth rate is represented as 1.14. This is a linear transformation and does not alter statistical inference.

All subsequent statistical comparisons were conducted on this normalized sales-growth measure across the three mutually exclusive groups: growth, value, and both. Separating the five overlapping names into their own category does not widen or manufacture differences between growth and value; it simply prevents double-counting and preserves the validity of the comparison.

Findings

1) Group positioning

The mean normalized sales-growth value for the “both” cohort lies closer to the value cohort than to the growth cohort.

2) Statistical differences

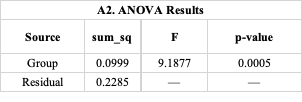

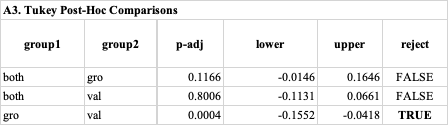

A one-way ANOVA confirms a statistically significant difference across the three cohorts (p < 0.001). Tukey post-hoc comparisons show:

A statistically significant difference between growth and value,

No significant difference between both vs. value, and

No significant difference between both vs. growth at the 5% threshold.

Thus, while growth and value differ significantly, the overlap group is not statistically distinct.

Interpretation & Portfolio Implications

The overlap cohort — securities appearing simultaneously in both VOOG and VOOV — does not differ statistically from either the growth or the value cohorts in forward revenue growth. However, its average growth level is numerically closer to the value cohort, indicating that overlap names lean toward value-like fundamentals on this dimension even though they do not form a statistically distinct group.

The clear and statistically significant gap between growth and value further indicates that expected sales expansion is an economically relevant discriminator across style classifications, supporting its use in style diagnostics or screening.

Appendix — Statistical Tables

Previous work on valuation of stocks in growth and value ETFs found here.

This particular post is free to all.

Your modest paid subscription supports this work.

One month free:

https://bernsteinbook1958.substack.com/fb965b7d

50 percent off annual membership ($30 total.)

https://bernsteinbook1958.substack.com/4d9daaf9