Abstract: Example presented here shows CHATGPT will use averages to answer a finance problem even when there is no unique answer because sequence of returns and variability of returns matters. The quality of CHATGPT analysis often depends on the specificity of the question. Hopefully, future versions of CHATGPT will more quickly consider the possibility of non-unique answers to questions.

The Finance Problem: I asked CHATGPT to consider three financial scenarios.

All three scenarios involved a person with $100,000 in an account disbursing 4 percent per year over a 10-year period with all disbursements made monthly at the end of the month.

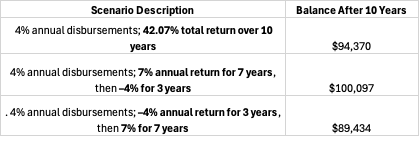

Scenario One: The account is invested in an asset that earns 42.07 percent total over a ten year period.

Scenario Two: Account is invested in an asset that earns 7 percent per year for the first seven years and – 4 percent per year for the next three years.

Scenario Three: The account is invested in an asset that earns -4 percent per year for the first three years and 7 percent per year for the next 7 years.

Note the 10-year return of all three scenarios is 42.07 percent. If CHATGPT gives us a unique answer for scenario one and different answers for scenarios two and three we have discovered a limitation because scenarios two and three are both consistent with scenario one.

CHATGPT put the answer in a table for me.

The analysis reveals that retiree account balances fall more than average returns when initial return during the early years of the disbursement period are negative.

Account balance calculations based on an average returns can be very deceptive as acknowledged by CHATGPT in an answer to this question.

In each of these scenarios the total return over 10 years is 41.07 percent, the case described in the first scenario. Is your assessment to the first scenario incorrect because the account balance depends on the variability and sequence of returns?

✅ Key Insight:

Even when the total return over 10 years is the same (e.g., +41.07%), the sequence of returns absolutely matterswhen there are withdrawals (or contributions) involved.

This phenomenon is known as the “sequence of returns risk”.

So CHATGPT understands and learns but will only answer the question given and will use averages and ignore “sequence of return risk” or even random variability unless specifically asked.

Again, CHATGPT is a great car but where it finishes in race depends on the driver.