Series I Bonds: Practical Guidance, Portfolio Applications, and Policy Pathways

A comprehensive guide to using Series I Bonds effectively—and rethinking how they fit into retirement security

Abstract

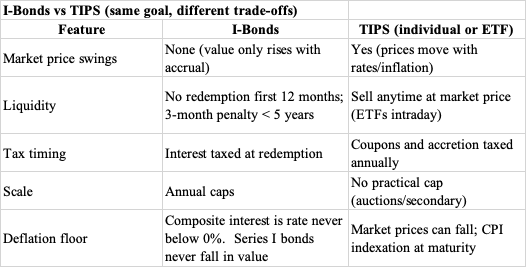

This article provides a practical guide to Series I Bonds in 2025, explores their features, strategic use for investors and retirees, and potential policy reforms to strengthen retirement security. It explains how Series I Bonds function, compares them with TIPS, demonstrates their resilience during inflationary shocks, and outlines ways they can stabilize portfolios. The piece concludes with policy ideas that would enhance accessibility and retirement-planning.

Introduction

Series I Bonds remain one of the most underappreciated tools for individuals seeking a simple, effective hedge against inflation. While often overshadowed by traditional bonds and 60-40 portfolios, Series I Bonds combine government-backed safety with inflation protection, making them particularly useful for retirees and long-term savers. In this article, we review their mechanics, compare them to TIPS, highlight strategic applications, and propose reforms to better align Series I Bonds with modern retirement needs.

Series I Bonds are:

Non-marketable savings bonds that combine a fixed rate at purchase with an inflation adjustment resetting each May and November; interest accrues monthly, compounds semiannually, and stops after 30 years.

Purchased directly from Treasury Direct, with no broker sales charges or fund expenses.

Provide a steady protection against inflation and rate shocks, without daily price swings—especially helpful for retirees who must draw income regardless of market conditions.

Subject to early redemption limits: no cash-out in the first 12 months; redemption within five years forfeits the last three months of interest. Series I bonds should not be considered liquid assets until they are held for five years.

Capped at $10,000 per person. However, each member of a household can purchase up to $10,000 and additional purchases through trusts and businesses are allowed.

Issued for up to 30 years of accrual, then stop earning.

Taxed federally at redemption or maturity, generally exempt from state and local taxes. Federal tax for a bond held for 30 years can be considerable, but would be smaller than tax on a distribution from a conventional retirement plan.

A simple, annual-purchase habit can build wealth and an inflation hedge. The bonds are more resilient than traditional bond funds and can improve performance of a balanced portfolio during volatile financial periods.

Go here for a more complete discussion of the attributes of Series I bonds.

Benefits of Series I Bonds to Investors:

Younger workers investing in a 401(k) plan can benefit from a market downturn because it creates an opportunity to purchase assets at a lower price.

By contrast, retirees who are distributing assets to fund consumption need an asset, which will not fall in value regardless of the market.

Many workers and retirees attempt to reduce the impact of a market downturn on their portfolio by investing a substantial portion of their portfolio in a traditional bond fund or by investing in a balanced 60-40 portfolio.

A traditional bond portfolio and a 60-40 portfolio did provide some protection for investors in the 2008 downturn. However, the decision to hold bonds as a hedge was not effective in the 2020 pandemic downturn because of the historic and prolonged decline in interest rates, which followed the initial shorter shock to equity markets.

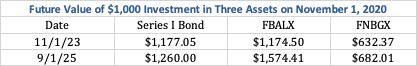

Data on returns from Series I bonds and closing adjusted fund prices was used to demonstrate potential advantages of the use of Series I bonds as the economy recovered from the pandemic but inflation and interest rates rose from historic lows.

Note:

• Series I Bond: Returns were calculated using official Treasury composite rates, compounded semiannually starting November 2020.

• FBALX (Fidelity Balanced Portfolio) and FNBGX (Fidelity Long-Term Treasury Bond Index Fund): Values were based on adjusted closing prices, scaled to reflect the growth of a $1,000 investment from November 1, 2020.

Series I bonds provide better protection against a prolonged increase in interest rates, often associated with an increase in inflation than a traditional long term bond fund.

The inclusion of Series I bonds in a balanced portfolio would lead to enhanced returns compared to the case where all bonds in the balanced portfolio were traditional bonds.

The use of Series I bonds to stabilize wealth during volatile market periods is especially important for younger retirees who need to distribute retirement funds regardless of market circumstances.

Policy ideas that would assist savers

Permit I-Bonds inside retirement accounts (IRA/401k wrappers) while keeping them non-marketable.

Allow workplace plans to offer new-issue TIPS in laddered form.

Raise and CPI-index the I-Bond purchase cap; enable payroll deduction and brokerage access without fees.

Require plans to include an inflation-protected reserve sleeve for late-career and retiree cohorts.

Practical takeaway

A steady habit of annual I-Bond purchases builds a durable hedge against inflation and rate shocks.

Series I bonds can help retirees stabilize consumption and reduce depletion of their retirement assets during market downturns.

A modest policy change allowing the purchase of Series I bonds inside of retirement accounts would prevent many retirees from outliving their retirement assets.

Authors Note: Several additional articles examining potential benefits from the use of Series I bonds will be available for paid subscribers soon. These applications include the calculation of wealth obtained from past purchases of Series I bonds, the impact of Series I bonds on portfolio return and risk, the impact of Series I bonds on the longevity of retirement assets, and policy proposals for expand use of Series I bonds.

Links will be added here once the paid posts are live.