Introduction:

Often households nearing retirement find they do not have enough liquid assets to sustain themselves for the long-term. One potential choice for some of these households is to downsize to a smaller home and eliminate existing debt.

A financial advisor or realtor attempting to advise clients on whether to downsize or stay in their current residence needs to provide information on four issues – (1) the financial sustainability of the current living arrangement, (2) potential addition in liquid wealth from downsizing, (3 impact of downsizing on financial strategy and overall financial security, and (4) the timing of the downsizing decision.

Financial sustainability involves the question of whether a retiree with their current home, mortgage, and liquid financial wealth can remain in their residence without outliving their retirement resources.

The estimate of additional liquid financial wealth from downsizing after the elimination of mortgage debt and the purchase of a replacement home is a relatively straight forward calculation. The first objectives of the additional financial wealth are to increase resources available for consumption in retirement and to reduce the likelihood a person will outlive their retirement resources.

The additional financial resources obtained from the downsizing allows many retirees to pursue other financial objectives, which will further enhance financial security during retirement. These objectives include:

· delay in claiming Social Security benefits to obtain higher Social Security benefits,

· delay in the disbursement in retirement plan assets to take additional advantage of tax deferral and increase wealth in retirement plans,

· the conversion of traditional retirement assets to Roth asset to lower the amount of tax paid and to increase funds for spending in retirement years.

These additional financial maneuvers, which often can only be achieved after an infusion of cash from the downsizing, can substantially improve financial security in retirement.

The issue of the timing of the downsizing decision involves the choice between downsizing now or downsizing in the future after real estate prices have changed and the outstanding balance on the mortgage has been further reduced.

The memo outline the information needed to make informed decisions about whether it is necessary to downsize to a smaller home and on how to maximize the potential financial benefits of the downsizing.

· The first stage of the decision process involves obtaining a measurement of financial sustainability if the person stays in their current home.

· The second stage of the decision process involves calculating the increase in liquid financial wealth obtainable from downsizing.

· The third stage of the decision process is to recalculate financial sustainability after downsizing.

· The four stage of the decision process is to list potential financial strategies which become achievable after a house downsizing decision.

· The fifth stage of the decision process involves measuring potential improvement in financial security from delaying the decision to downsize.

· The sixth stage of the decision process involves comparing benefits from immediate downsizing to benefits from delaying the move.

Financial Sustainability:

The financial sustainability calculation is addressed by comparing expected expenses in retirement to the maximum amount a person could spend given their financial resources.

Expected expenses, the amount a person will spend, is treated as a percent of the average of the last five years of income in working years. Expected expenses are higher for people with an outstanding mortgage than for people without an outstanding mortgage.

Expected expenses are modeled here as 60 percent of final income for people without a mortgage and 75 percent of final income for people with a mortgage.

Expected expenses are compared to the amount of money available to fund consumption.

The amount of money available to fund consumption is 4.0 percent of liquid (retirement and non-retirement assets) plus Social Security if the retiree claims Social Security benefits.

The choice of four percent is based on the four percent rule, a common benchmark determining the appropriate spending level in retirement.

Financial sustainability is calculated both under the assumption the person claims Social Security benefits and the assumption the person does not claim Social Security benefits. Many retirees will delay claiming Social Security to become eligible for a larger benefit in the future.

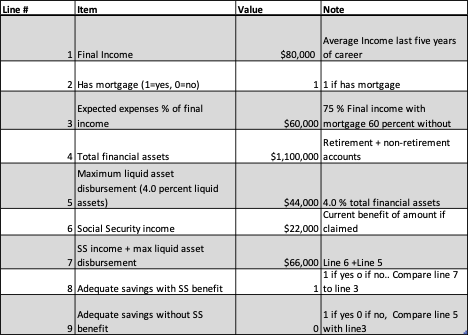

The financial sustainability calculation for a hypothetical retiree is outlined in the table below.

Expected expenses for the hypothetical retiree is greater than four percent of assets but less than the sum of four percent of assets and Social Security income.

The hypothetical retiree in this example has adequate resources to stay in their current home if they are claiming Social Security but not enough if they delay claiming Social Security benefits.

Table One: Financial Sustainability Calculation:

Financial sustainability calculation for a hypothetical worker. A more refined estimate might be based on projected expenses based on health, travel plans, and actual mortgage or debt obligations. The analyst could also deviate from the four percent rule by incorporating information on age and future life expectancy.

Additional wealth and impact on financial sustainability:

A client considering whether to downsize now needs to have a rough idea of how much cash they will obtain for the transaction and the impact of the elimination of debt on their ability to have a financially sustainable retirement.

The amount of cash obtained from a downsizing depends on the sales price of the current home after selling and moving expenses, the amount of capital gains paid on the gain from the home, the cost of the replacement home, moving expenses and the amount of money spent on eliminating any existing mortgage.

· The calculation of the amount of cash from the purchase of a home is the house value minus the sum of selling costs, the capital gain on the house, and the amount spent on eliminating the mortgage.

· The amount left over after the purchase of the new home is the amount of cash from the sale of the home minus the sum of the purchase price of the new home moving costs and transaction costs.

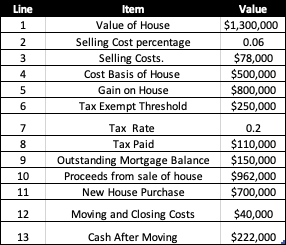

The impact of downsizing on wealth for a hypothetical client is illustrated by the table below.

Table Two: Financial Wealth from Downsizing Calculations

Proceeds from the house sale is equal to house value minus the sum of selling costs, taxes on gain, and outstanding mortgage balance. The cash after moving subtracts out the cost of the new house purchase and the moving costs.

The impact on financial sustainability:

The elimination of the mortgage and the addition of $222,000 in liquid financial asset will result in the retiree depicted in Table One having a more financially sustainable retirement.

· Total financial assets is $1,322.000

· Maximum liquid asset disbursement (4 percent of total assets) $52,880.

· Expected expense (now 60 percent of final income because of elimination of the mortgage) $48,000.

The retiree is in a financially sustainable position without claiming Social Security benefits because 4 percent of assets exceeds expected expenses.

The client’s happiness will depend on the features and the location of the new house. This entire exercise is predicated on a suitable house consistent with new house purchase value in line 11 of the table.

The elimination of the mortgage will reduce expected expenses and the increase in liquid assets will facilitate other financial changes that will increase financial security of your client.

Changes in Financial Strategy:

The elimination of the mortgage and the additional cash from downsizing allow a retiree to adopt different financial strategies, which will further increase retirement wealth and reduce the likelihood that a person outlives retirement resources.

These strategies include:

· Delaying claims of Social Security benefits to obtain a higher annual benefit,

· Delay spending funds in retirement accounts to allow for additional tax deferral,

· Convert traditional retirement assets to Roth assets to lower taxes and increase disposable income.

Benefits from ability to receive a higher Social Security benefit: Social Security benefits are larger for people who delay claiming. The increase in average annual benefit is 42.8 percent for people who claim the full benefit at age 67 instead of the first available benefit at age 62 and an additional 8.0 percent per year for each additional year of delay until age 70.

Go here to the SSA site for a discussion of advantages of waiting until the full retirement age to claim Social Security benefits. Go here for a discussion of the advantage to claiming Social Security at age 70.

As noted above, the person with an initial financial sustainability calculation as described in Table One and financial wealth from downsizing as described in Table Two need not claim Social Security after downsizing.

Benefits from foregoing disbursements from retirement plans: The house downsizing decision allows a person to forego retirement plan disbursements which results in additional tax deferral and growth of retirement assets.

· A person leaving $500,000 untouched and untaxed in a retirement plan earning 8.0 percent per year for eight years will have over $730,000 ($500,000*(1.08)5) in retirement asset if they realize 8.0 percent returns.

A person using retirement assets early in retirement could quickly deplete their retirement account especially if market returns are poor during early years in retirement.

The possibility of delaying retirement plan disbursements and relying exclusively on non-retirement liquid wealth to fund consumption requires substantial non-retirement liquid wealth, which is often only available if the retiree downsizes

A financial presentation on advantages of downsizing would document differences in wealth outcomes between a person who immediately distributes retirement funds at age 62 and a person who is able to delay retirement plan disbursements

Benefits from converting traditional retirement assets to Roth assets:

The additional cash from the downsizing facilitates conversion of traditional retirement assets to Roth assets. These conversions substantially reduce future tax obligations for two reasons.

· The Roth distribution is not taxed.

· The Roth distribution is not included in the amount of Social Security income subject to tax. Go here for a discussion of the taxation of Social Security benefits.

A transaction involving the conversion of traditional retirement assets to Roth assets in a year where the retiree is not claiming Social Security benefits or distributing funds from a retirement plan followed by distributions from the Roth IRA five years later will result in returns with an average annual return of over 30 percent. A previous post in this blog explored the conversion of traditional retirement assets to Roth assets in greater detail.

The ability to convert traditional retirement assets to Roth assets in retirement requires the existence of substantial liquid assets to fund current consumption during the years of conversion when the taxpayer has low income and a low marginal tax rate. Often the only households capable of converting substantial traditional retirement assets to Roth assets are retirees who have obtained a lot of cash by downsizing to a smaller home.

A presentation on benefits from downsizing should include a slide on potential benefits achieved from converting traditional retirement assets to Roth asset. This slide would contain information on the amount of assets converted and the impact on the conversion on future taxes and future consumption.

The Timing of the House Downsizing Decision:

The timing of the house downsizing decision comes down to the relative profitability of downsizing now versus downsizing sometime in the future and the ability of the retiree to make strategic financial changes if they delay downsizing.

The relative profitability of current versus future downsizing transactions is impacted by real estate prices now and in the future and projected changes in the outstanding mortgage balance.

An increase/decrease in overall real estate market will increase/decrease the cost of both the original and replacement house. Hence, an increase in overall real estate prices will not automatically make the downsizing transaction more profitable when both the price of the existing home and the replacement home rise in tandem.

Informed projections on wealth obtained from downsizing can be obtained by placing projections of future house prices (both the current home line 1 and the replacement home line 11) in Table Two and comparing these projections to wealth obtainable under current house prices.

The reduction in the outstanding mortgage balance will also increase funds from downsizing. A reduction in mortgage balance leading to increased house equity can be substantial for older mortgage nearing maturity.

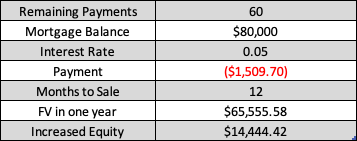

The table below provides an estimate of the additional equity obtained from delaying downsizing for one year when the mortgage has 60 months remaining, an $80,000 outstanding balance and a 5.0 percent interest rate.

Table Three: Mortgage Balance Reduction from one-year delay in downsizing

This person would realize an additional $14,444.42 of equity through a reduction in their mortgage balance by downsizing in one year instead of downsizing immediately.

The additional equity from waiting a year to downsize appear small for the homeowner described by Table Two because in that instance an immediate downsizing would allow the retiree to obtain a higher Social Security benefit, delay disbursements from retirement plans, and convert traditional retirement assets to Roth assets.

Also, the existence of a low interest rate on a mortgage is often not a reason for a retiree to stay put. The more appropriate criteria are whether staying in the current residence is financially sustainable and whether downsizing enhances financial security.

It is important that you and your client look at the big picture.

Potential tradeoffs and concluding remarks:

Decisions on whether and when to downsize are complex because of multiple considerations and tradeoffs. Many clients who plan on immediately claiming Social Security and disbursing funds from retirement accounts as soon as they retire could benefit by downsizing to a smaller home and using the resources to enhance their retirement wealth.

A research project involving the collection and evaluation of information on financial sustainability and potential wealth from house downsizing could help determine how many people should consider downsizing to maximize financial security in their retirement years. The decision making process presented here should help with this effort.