The Narrow Fight Over Subsidies Misses the Real Health Insurance Crisis

The shutdown focuses on enhanced ACA tax credits, but the real cost drivers—rising premiums and structural inflation—run much deeper.

The 2026 Marketplace will cost more for nearly everyone, not just because of subsidy changes, but because underlying premiums are rising at their fastest rate in five years. The two biggest losers are taxpayers, who must fund larger subsidies as premiums climb, and middle-income people just above 400 percent of the Federal Poverty Level (FPL), who will once again receive no aid at all. This second group is often self-employed or early retirees—hardly affluent—yet fully exposed to premium inflation on the open market.

This fight centers narrowly on subsidy design. It leaves untouched several pressures shaping health care costs for many individuals — rising cost-sharing requirements, more restrictive provider networks, and increased use of prior-authorization rules.

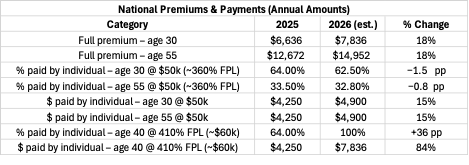

The table below summarizes national averages for single adults buying benchmark silver plans. It compares 2025 to 2026 for different age and income levels.

Source: national Silver-plan averages from CMS filings and KFF modeling; 2026 values projected using state-filed rate increases.

Even though the enhanced credits are scheduled to expire, the share of the premium paid by a person earning about $50,000 actually declines slightly between 2025 and 2026. That’s because the overall rise in premiums has a larger impact on the total subsidy formula than the policy change itself—illustrating how much of the affordability problem now stems from rising underlying costs rather than from subsidy design.

Premiums are increasing roughly 15–18 percent nationally for 2026. Several structural forces explain the jump:

Medical inflation: provider and drug costs continue to rise faster than general inflation.

Reinsurance and risk adjustment: post-pandemic enrollment shifts left insurers with older, sicker pools.

Network compression: earlier savings from narrow EPO networks have been exhausted.

Administrative costs: new federal interoperability and prior-authorization rules add back-office expense.

These forces push base premiums upward regardless of subsidy design.

For 2025, enhanced credits under the American Rescue Plan eliminated the hard income cap for premium subsidies. Beginning in 2026, that protection disappears. Anyone earning just above 400 percent FPL (about $60,000 for a single person) will again receive no federal help—a sudden jump from paying roughly $4,250 a year to nearly $7,800.

This “subsidy cliff” affects a modest share of Marketplace users (around 10–15 percent), but its impact per household is severe. These are not wealthy buyers: most are middle-class professionals, freelancers, or early retirees who rely on the exchanges precisely because they lack employer coverage.

Restoring enhanced credits would cushion these households, especially those straddling the 400 percent FPL threshold. Yet even a full restoration would not stop total premiums from rising. Subsidies change who pays, not what care costs.

That leaves two uncomfortable facts:

Taxpayers shoulder a growing share of every year’s premium increase.

Those just above 400 percent FPL shoulder all of it.

The larger challenge lies in slowing the medical-cost curve itself—addressing provider pricing, drug costs, and administrative overhead that drive premium inflation year after year.

Bringing back enhanced ACA credits would help, but it treats the symptom, not the cause. The real issue is the relentless rise in underlying premiums—a systemwide inflation problem disguised as a political fight over subsidies.

Authors Note: This analysis of the budget fight over health care is offered as a free note. If you’d like to support this work — and receive premium posts, working drafts, and early access to new analyses — I’m offering two introductory options:

· 🎓 Six months free for new paid subscribers

· 💡 50% off an annual membership (only $30 total)

Paid subscribers receive a steady stream of research-driven writing on personal finance, health insurance, retirement strategy, and the stock market. Your support makes it possible to continue and expand this kind of work.