The Sequence of Returns Puzzle: Why Timing Hurts Workers and Retirees in Opposite Ways

Why do crashes at the start of retirement ruin futures, while crashes at the start of a career barely matter? Sequence of returns risk flips the script for workers and retirees.

Introduction

Intuitively, a downturn in the stock market early in the career of a worker will have much less impact on eventual retirement wealth than a stock market downturn at the end of retirement. (The downturn in the market early in a worker’s career only affects a small portion of savings, while a downturn at the end of career will affect all savings.)

Equally intuitively, a market downturn at the beginning of retirement will be substantially more detrimental to the retiree than a market downturn nearing the end of life. A depletion of retirement wealth due to adverse market returns at the onset of retirement, perhaps at age 62, substantially increases the likelihood a retiree outlives retirement savings.

The order of investment returns can matter as much as (or more than) the average return itself. This paper includes:

1. A review of the literature on sequence risk.

2. A simulation of the impact of sequence of returns on wealth accumulation during working years.

3. Empirical evidence on how stock market losses early in retirement can substantially reduce wealth and disrupt retirement outcomes.

Literature Summary

There is substantial literature in both academic journals and the financial press documenting the importance of sequence of returns on adequacy of retirement savings.

The literature shows that the best financial outcomes for retirees occur when returns in working years are robust at the end of a worker’s career and returns in retirement are robust at the beginning of retirement.

Some key studies in this literature include:

- Wade Pfau: Regression-based evidence showing that late-career returns dominate wealth accumulation, while early-retirement returns dominate decumulation.

- Michael Kitces: Explores sequence risk for both savers and retirees and advocates strategies like rising equity glidepaths. Particularly, he frames the early years of retirement as a 'danger zone' for depletion risk.

- Morningstar (John Rekenthaler): Illustrates how identical average returns can lead to widely different retirement outcomes depending solely on sequencing.

- Vanguard Research: Demonstrates how retiring into bear markets significantly increases the likelihood of running out of money under fixed withdrawal rules.

- David Blanchett & Larry Frank: Examine adaptive withdrawal strategies that can mitigate sequence risk.

- David Bernstein (2025): In 'The Retirement Date Lottery: Why 2000 and 2007 Retirees Lived Different Financial Realities,' Paper documents financial stress on cohort retiring in 2000, a group experiencing two major market downturns in the first decade of retirement.

Worker Phase Example

The impact of sequence of returns on the accumulation of retirement wealth during working years was illustrated by a simple simulation model. The assumptions of the model, the results of the analysis, and the discussion of these results are presented below.

Modeling Notes

- Career length: 30 years

- Starting salary: $60,000, growing at 2% annually

- Savings rate: 5% of wages years 1–10, 6% years 11–30

- Contributions made at year-end (no return in contribution year)

- Baseline returns: steady 7% annually

- Scenario 1 (early-career shock): –30% in year 1, 0% in years 2–4, then 7% thereafter

- Scenario 2 (late-career shock): 7% through year 26, then –30% in year 27, followed by 0% in years 28–30

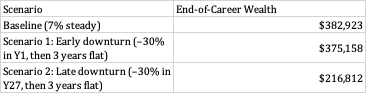

End-of-Career Wealth Comparison

Interpretation

- Under steady returns, portfolio grows to ~$383K.

- A shock early in the career causes manageable loss—compounding and higher contributions help recover.

- A late-career shock causes a dramatic reduction (~$217K) since the portfolio was largest at retirement—most of wealth was exposed.

Retiree Phase Example – The 2000 vs. 2007 Cohorts

The potential impact of sequence of returns on the rate of depletion of retirement wealth was illustrated by my recent Substack note documenting differences in the trajectory of retirement wealth for a person retiring in 2000 and in 2007. The retirement trajectory for the two cohorts was examined for two different portfolio choices – SPY, 100 percent in the S&P 500, and FBALX, a balanced 60-40 fund.

The link to this Substack article is presented in the appendix below.

Methodology (Bernstein, Sept 1, 2025)

- Starting balance: $1,000,000

- Withdrawal rule: 4% initial ($40,000/year), inflation-adjusted

- Portfolios: SPY (100% equities) and FBALX (~60/40 balance)

- Retirement dates compared: January 2000 (dot-com bust + later crash) vs. January 2007 (just before GFC)

Key Findings

The findings reveal that sequence risk and the timing of retirement is decisive in both the determination of whether retirement wealth is adequate and optimal portfolio for a newly retired person (optimal at least after the fact).

- The 2000 SPY retiree ended up with only ~$832K by 2025, depleted by early shocks.

- By contrast, the 2007 SPY retiree surged to nearly $3.0M by 2025.

- That’s a more than 3.5× divergence in outcomes—all due to retirement timing.

- Diversified portfolios outperformed in bad timing:

- The 2000 FBALX retiree preserved much of the capital—resulting in ~$3.3M vs. ~$832K for SPY.

- The 2007 FBALX retiree had smoother returns but lagged SPY.

- Inflation amplified stress:

- Withdrawals grew to ~$73K (2000 retiree) vs. ~$64K (2007 retiree).

The difference between 2000 and 2007 results stems from the fact the 2000 retiree had to endure two market collapses early in retirement, the tech collapse and the great recession, while retirees in 2007 only experienced one market downturn before the market entered a period of robust economic growth.

Interpretation

This stark contrast underscores that early-retirement downturns can permanently damage the sustainability of withdrawals, aligning tightly with Kitces' description of sequence-of-returns risk and the peril posed by early dwell-time in retirement.

S

Appendix: Key Researchers & Sources

- Wade Pfau – The Lifetime Sequence of Returns

- Michael Kitces – Retirement Date Risk; Understanding Sequence of Return Risk & Safe Withdrawal Rates

- Pfau & Kitces – Reducing Retirement Risk with a Rising Equity Glidepath

- Vanguard Research – Safeguarding Retirement in a Bear Market

- Morningstar (John Rekenthaler) – Sequence Risk During Retirement; Not All Total Returns Are Created Equal

- David Blanchett & Larry Frank – The Dynamic Implications of Sequence Risk on a Sustainable Withdrawal Rate Strategy (JFP, 2013)

- David Bernstein (2025) – The Retirement Date Lottery: Why 2000 and 2007 Retirees Lived Different Financial Realities (Substack)

Link: https://bernsteinbook1958.substack.com/p/preliminary-results-the-retirement