Used Car Loan Affordability Analysis 2015–2025

Bigger balances, higher rates, longer maturities — and what AI can (and can’t) add to the analysis.

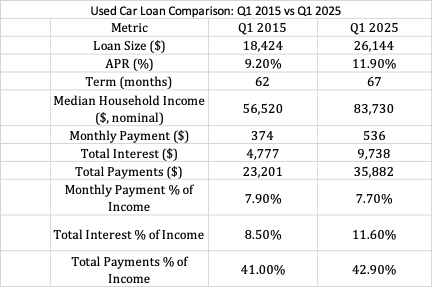

Abstract: Used car financing has changed dramatically over the past decade. Loan sizes are up, APRs are higher, and households stretch terms to keep monthly payments manageable — but at the cost of much larger lifetime obligations. This post walks through a clear 2015–2025 comparison and asks a simple “what if” question about maturities. Along the way, I also reflect briefly on using AI tools to run the numbers faster, and why careful verification still matters.

Introduction

Over the past decade, U.S. used-vehicle financing has shifted substantially loan sizes climbed, terms lengthened, and interest rates rose.

The analysis draws on Experian’s State of the Automotive Finance Market reports for loan metrics and Census income data from Q1 2015 and Q1 2025 to evaluate the impact of these changes on loan costs and household finances.

A second more limited objective is to consider how researchers can use ChatGPT-class tools to speed up data collection and basic analysis, while recognizing the need for careful verification.

Small differences in data choice (e.g., real vs. nominal values, or different vintages) illustrate how choices made by the AI impact results and on the need for human scrutiny to maintain accuracy.

Analysis and Discussion

Between 2015 and 2025, used car loan amounts and interest rates both increased sharply, pushing monthly payments from about $374 to $536.

Borrowers stretched terms from 62 to 67 months to help manage the higher balances.

The longer term and higher household income resulted in a drop in monthly payment burdens.

However, the total lifetime cost of borrowing rose significantly because of the higher loan maturity.

We consider what would have happened to both monthly payment burdens and total lifetime payments of loan maturities had remained at 2015 levels. Two outcomes stand out.

· The monthly payment would have risen to about 8.3% of household income instead of falling to 7.7%.

· The lifetime loan burden would have been smaller -- $33,200 instead of $35,900.

These two sensitivity checks highlight the double-edged role of longer maturities.

Longer maturities create shorts-term payment relief but increased lifetime costs and increased exposure to economic or financial shocks that could interrupt repayments.

We also explored robustness of results by repeating analysis conducted in one AI session with a second section using the exact same prompt.

Minor differences in reported 2015 values (loan size and median income) caused small shifts in dollar amounts and percentages, but the overall affordability narrative is stable: bigger loans, higher rates, longer terms, modestly higher monthly payments in nominal dollars, and much greater lifetime borrowing costs by 2025.

After a second AI run the AI was asked to explain and justify discrepancies and work out the most appropriate variable choice.

This exercise also highlights that researchers using AI to retrieve or summarize data must take care in verifying whether figures are expressed in real or nominal terms, or whether slightly different data vintages are being selected, since these seemingly minor choices can alter numerical results even if the overall interpretation remains the same.

Conclusion

This analysis shows that used car financing has become substantially more expensive between 2015 and 2025, with larger loan balances, higher APRs, and sharply higher lifetime payments. The burden of monthly payments relative to household income has been tempered by the steady rise in maturities, which spread costs over a longer horizon. The result is a tradeoff for households: loans that feel manageable month to month, but which accumulate into significantly higher long-term obligations.