What Drives Price in Large-Cap Equities: Earnings Alone, or Earnings × Growth?

Evidence from robust linear models using voog/voov constituents

Investors debate whether valuation is “just earnings” or “just growth.” In this note I use regression models built from the largest holdings of two ETFs -- VOOG and VOOV to address this issue. A robust regression model, based on the intuition behind the PEG ratio, suggests that earnings and growth interact to impact stock price.

Introduction / Overview

This study examines whether earnings per share and expected revenue growth jointly explain cross-sectional variation in equity prices. The sample consists of the 25 largest reported holdings of the Vanguard large-cap growth ETF (VOOG) and the Vanguard large-cap value ETF (VOOV).

Five securities present in both lists were included once, yielding 45 unique firms. For each firm, price per share and earnings per share were taken from Yahoo Finance, and expected sales growth was taken from the “Next Year” estimate under the Revenue section of the Analysis tab.

The objective is to test whether the pricing of earnings varies with expected growth, and whether interaction terms between earnings and expected growth supply explanatory power beyond their main effects.

Methods

Price per share was regressed on centered earnings, centered expected sales growth, and their interaction. The primary specification used a robust (Huber) linear estimator to reduce the impact of high-influence observations without removing them from the sample.

Results

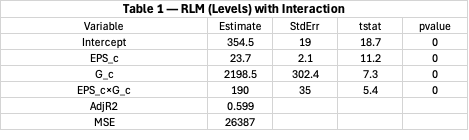

Table 1 reports the robust linear specification including the interaction. Earnings and expected sales growth are individually significant, and the interaction term is also statistically significant in the robust linear model. This indicates that the pricing of earnings is not uniform across growth levels: the market appears to pay more per dollar of earnings when expected growth is above average.

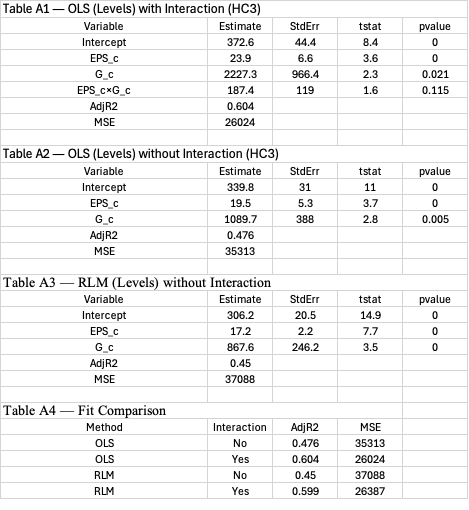

Including the interaction materially improves fit relative to a main-effects-only model in both OLS and robust estimation. In OLS with robust errors, the interaction is not statistically significant; however, once outlier influence is downweighted the interaction becomes significant and reduces prediction error.

Discussion

Conceptually, the specification parallels the intuition behind PEG ratios, which also embed the idea that the market capitalizes a dollar of earnings more richly when expected growth is higher. The interaction term operationalizes this intuition in a linear pricing model. In the linear specification, both earnings and expected sales growth explain cross-sectional price variation, and allowing their interaction improves explanatory performance.

In the linear specification, both earnings and expected sales growth explain cross-sectional price variation, and allowing their interaction improves explanatory performance. The fact that the interaction is detected under robust estimation and absent under unadjusted OLS indicates that high-influence observations obscure the effect in standard regression but do not generate it.

In alternative log-price specifications estimated as a robustness check, the interaction term does not achieve significance, and a nested F-test confirms that its contribution is not statistically supported in the log specification.

Conclusion

The evidence supports an earnings–growth interaction in linear price space under robust estimation: the pricing of earnings rises with expected sales growth. This effect is not statistically supported in log-price models and is not detectable in ordinary least squares without accounting for outliers. Thus, the existence of the interaction is conditional on linear specification and robust estimation but materially improves fit when those conditions hold.

APPENDIX

Methods

The sample consists of the top reported holdings of VOOG and VOOV. Five overlapping names were included once, yielding 45 unique firms. Price and earnings per share were taken from Yahoo Finance; expected sales growth was taken from the “Next Year” estimate under the Revenue section of the Analysis tab and expressed as a decimal. Regressors entering interactions were mean-centered. The dependent variable is price in levels.

The primary specification is a robust (Huber) linear model with price regressed on centered earnings, centered expected sales growth, and their interaction. The interaction tests whether the price–earnings slope varies with growth. Ordinary least squares with HC3-robust errors was estimated for comparison.

Notes on Sample and Methodological Limits

The analysis is cross-sectional and does not imply causality or predictive validity. The interaction is statistically supported only in the linear specification with robust estimation. The models exclude risk controls, sector structure, leverage, profitability measures beyond EPS, and macro conditions; results are conditional on this specification.\

Previous work considering differences between growth and value stocks can be found here

This particular post is free to all.

Your modest paid subscription supports this work.

One month free:

https://bernsteinbook1958.substack.com/fb965b7d

50 percent off annual membership ($30 total.)

https://bernsteinbook1958.substack.com/4d9daaf9