When HDHP Beats Standard: A GEHA Case Study

Why GEHA’s high-deductible plan dominates its standard plan under 2025 pricing — and why this result is not universal.

This piece compares GEHA Standard and GEHA HDHP using 2025 benefits and shows that the HDHP wins under almost every spending scenario — even with zero voluntary HSA contributions. This is not a generic “always choose HDHP” result; GEHA’s HDHP is unusually favorable compared with most HDHPs on the market.

Abstract. Using 2025 GEHA FEHB plans as a case study, we compare a Standard PPO‑style plan to an HDHP under a wealth framing. GEHA’s HDHP is unusually favorable relative to typical HDHPs in the broader market, with a moderate deductible and lower OOP maximum. Under these GEHA parameters, the HDHP generally dominates Standard even with $0 employee HSA contribution. The gap between HDHP and Standard is even larger for full contributions at a 30% marginal tax rate. These findings do NOT generalize to higher‑deductible, higher‑OOP HDHPs common in the employer and ACA markets.

Introduction. This analysis examines choice between a Standard PPO‑style plan and a High Deductible Health Plan (HDHP). We examine GEHA’s 2025 FEHB plans because the parameters are public, stable, and relevant during open season.

GEHA Health Plan Characteristics:

Premiums: Standard $80.32 bi-weekly (≈$2,088/yr); HDHP $76.27 (≈$1,983/yr)

Deductibles: Standard $350; HDHP $1,650

OOP max (in-network): Standard $6,500; HDHP $6,000

The HDHP has a lower in-network OOP maximum ($6,000) than GEHA Standard ($6,500),

HDHP HSA pass-through: $1,000

GEHA HDHP has unusually moderate cost‑sharing.

In the employer market, the average single deductible across plans is ∼$1,900 and HDHP deductibles are typically in the mid‑$2,000s.

In the ACA marketplace, deductibles often exceed $5,000 and OOP caps can reach the legal maximum for a HDHP ($9,200 in 2025).

Results from this analysis do not generalize to the choice between other HDHP and standard plans in the market.

This note models the 2025 FEHB decision between GEHA Standard and GEHA HDHP (HSA-eligible) for a Self-Only enrollee, under the assumption HSA dollars are treated as wealth, not merely spending offsets.

Results:

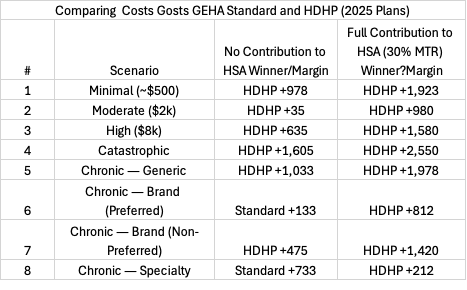

Two scenarios are considered – (1) no voluntary HSA contribution and (2) the other maximum allowable HSA contribution for a taxpayer at the 30 percent marginal tax rate. The cost of health insurance for the standard GEHA plan and the HDHP GEHA plan are presented for eight different health expenditure scenarios.

The “margin” measures the difference in value obtained by choosing one plan over the other — it is simply the dollar gap in net cost.

One of the key advantages of HDHP is tax gains from deductible voluntary contributions to a health savings account. However, the GEHA HDHP is competitive to the GEHA Standard plan in all expenditure regimes even when there are no voluntary contributions to the HSA.

No voluntary HSA contributions:

· HDHP is dominant in the four baseline spending regimes (1–4).

· Standard is dominant under two high-pharmaceutical spending scenarios.

A rule change allowing for insurance reimbursement for pharmaceuticals used for chronic conditions prior to the full deductible being met would further reduce cost associated with the higher deductibles.

Voluntary Contributions to HSAs:

Additional benefits from the use of a HDHP occur for people who make voluntary contributions to HSAs.

In 2025 the IRS allows a person with Self-Only HDHP coverage to put up to $4,150 into an HSA. GEHA already deposits $1,000 of that on your behalf — that money counts against the limit.

That leaves $3,150 an employee could contribute if they chose to “max out” the HSA. At a 30% marginal tax rate, the tax benefit is $945, further reducing the cost of the HDHP. This impacts the net cost of the high-deductible health plan.

· With full HSA funding at 30% MTR, the HDHP dominates the standard plan in every scenario.

The HDHP becomes even more attractive at higher marginal tax rates.

Conclusion

Under GEHA’s 2025 pricing and Method 1 framing (HSA dollars treated as retained wealth), the HDHP generally dominates Standard across baseline spending levels and most chronic medication cases — and when full HSA contribution at a 30% marginal tax rate is assumed, HDHP wins in all of the modeled scenarios.

Many people believe that HDHPs are for rich people in high marginal tax brackets. The GEHA HDHP available for federal employees is competitive even when there are no voluntary contributions leading to additional tax advantages.

This result does not generalize to all markets. Many HDHPs outside FEHB — especially on the ACA marketplace — have far higher deductibles and out‑of‑pocket ceilings. Also, HDHPs available on state exchanges DO NOT have a pass through to the HSA account because recipients receive a partial premium subsidy based on income. The source of funds for the pass through on employer-based plans is funds from the employers.

I suspect a study comparing standard to HDHP plans on state-exchange markets would not find the HDHP to so consistently be the better buy.

This GEHA analysis is being released as a free post. If you want to support this work — and receive premium posts, working drafts, and early access to new analyses — I am offering two introductory options:

• Six months free for new paid subscribers

https://bernsteinbook1958.substack.com/cea31403

• 50% off an annual membership (only $30 total)

https://bernsteinbook1958.substack.com/4d9daaf9

Paid subscribers receive a steady stream of research-driven writing on personal finance, health insurance, retirement strategy, and the stock market. Your support is what makes it possible to continue and expand this kind of work.

Appendix: List of modeling decisions and methodological choices

Framing choices

Method 1 framing — treat HSA deposits (employer + tax benefit on employee contribs) as retained wealth, not merely as spending offsets.

Cash-flow framing (Method 2) was not used in this paper but noted as an alternative that could flip results.

Plan selection choices

Restricted analysis to GEHA FEHB Self-Only 2025 — not general U.S. employer HDHPs and not Marketplace plans.

Recognized GEHA HDHP is not representative — unusually low deductible and OOP max for an HDHP.

Did not mix Federal vs Marketplace because of structural differences: age rating, subsidies, absence of employer HSA contributions, etc.

Scenario modeling choices

Modeled deterministic expenditure regimes, not probabilities or expected values.

Used nominal spend buckets (minimal, moderate, high, catastrophic) rather than utilization mixes or claims distributions.

Added three chronic Rx cases as stand-alone scenarios (generic / moderate brand / specialty) instead of embedding within the four spend bands.

Contribution & tax assumptions

Ran two passes: (a) $0 voluntary HSA contribution, (b) full employee HSA contribution at 30% marginal tax rate.

Applied marginal tax benefit only to employee HSA contributions, not to the GEHA pass-through.

Did not model partial contributions or break-even contribution levels, because dominance already held at $0 contribution.

Comparison metric

Defined Net Cost = premium + OOP − HSA credits (and − tax value when included).

Used margin (difference in net cost) to indicate strength of dominance rather than just a binary winner.

Scope limitations explicitly adopted

Results explicitly scoped to in-network spending only.

No modeling of behavioral or cash-timing effects (e.g., liquidity constraints).

No modeling of expected utility or risk aversion.

No modeling of out-of-network asymmetries or premium subsidy mechanics.

Interpretive commitments

Dominance in this paper is a GEHA–Method-1 output, not a universal claim about HDHPs.

A future paper is required for Marketplace/Employer pairs with same issuer / same metal / same network to generalize outside FEHB.